Irs 2025 Tax Brackets Table. There are seven tax brackets for most ordinary income for the 2025 tax year: New irs tax brackets 2025.

Employees and payees may now use the irs tax withholding estimator, available at irs.gov/w4app, when. The 2025 tax projections are just one of the features of.

Federal Withholding Tables 2025 Federal Tax, As your income goes up, the tax rate on the next layer of income is higher. The irs will publish the official tax brackets and other tax numbers for 2025 later this year, likely in october.

How To Compare Tax Brackets 2025 With Previous Years Fancy Jaynell, Federal tax brackets and tax rates. Taxable income up to $11,600.

Irs 2025 Standard Deductions And Tax Brackets Danit Elenore, There are seven (7) tax rates in 2025. There are seven federal tax brackets for tax year 2025.

20232024 Tax Brackets and Federal Tax Rates NerdWallet, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

Tax rates for the 2025 year of assessment Just One Lap, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Tax brackets for people filing as single individuals for 2025.

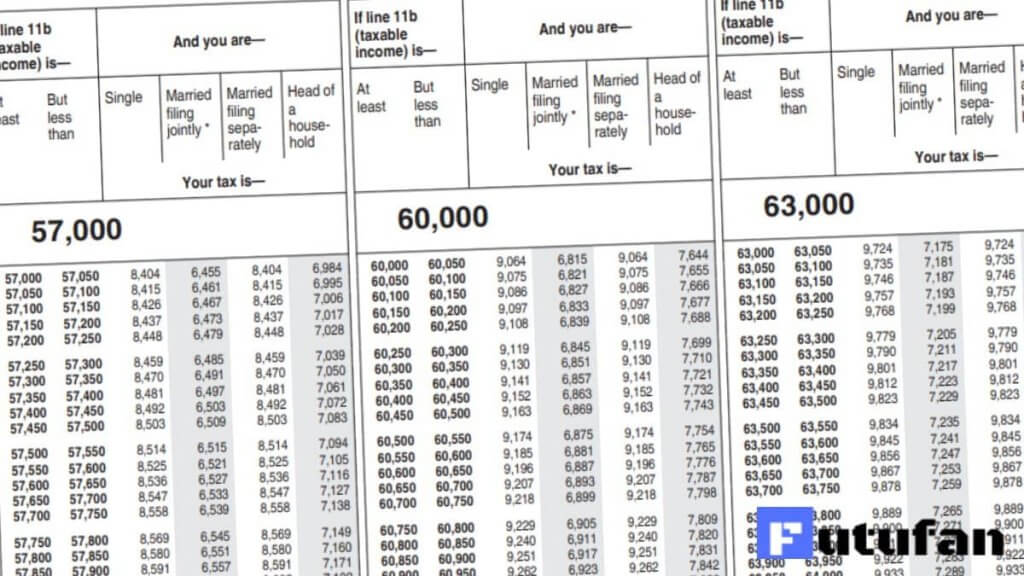

IRS Tax Tables 2025 2025, Tax brackets for people filing as single individuals for 2025. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, The federal income tax has seven tax rates in. The internal revenue service (irs) adjusts tax brackets for inflation each year, and because inflation remains high, it’s possible you could fall into a lower bracket.

Tax Rates 2025 To 2025 2025 Printable Calendar, Taxable income up to $11,600. Swipe to scroll horizontally 2025 tax brackets:

Tax Brackets 2025 What I Need To Know. Jinny Lurline, These brackets apply to federal income tax returns you would normally file. Swipe to scroll horizontally 2025 tax brackets:

Tax Brackets 2025 Married Jointly California Myrle Tootsie, 10%, 12%, 22%, 24%, 32%, 35% and 37%. There are seven tax brackets for most ordinary income for the 2025 tax year: